2025 Annual Enrollment

K-C is committed to creating a culture that prioritizes the wellbeing of our employees and their families by providing a comprehensive and competitive benefits package. Making the most of your benefits at K-C begins with selecting the right plan options to support you in the new year.

2025 Annual Enrollment is October 21 through November 1. Review the Annual Enrollment Guide to learn about the changes coming in 2025 and how to make the best choices for your benefits.

Note: For employees covered by a Collective Bargaining Agreement (CBA), please refer to your CBA for full details on your benefits eligibility. For information on the 2025 changes for your site, refer to the Annual Enrollment guide mailed to your home.

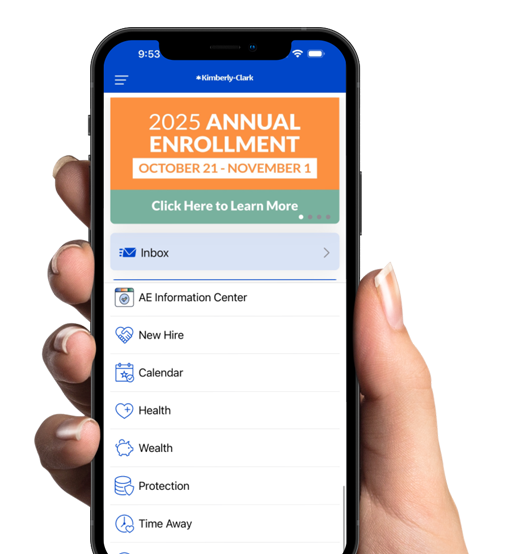

My K-C Benefits App & Website

Access all your K-C benefits information in one place with the My K-C Benefits mobile app – your one-stop-shop for all your K-C benefits.

For registration instructions, click here or scan the QR code.

What’s New for 2025?

Changes for the upcoming year include some enhancements to your protection benefits and necessary adjustments to the medical plan due to rising health care costs. We’re also offering more flexibility and cost-saving opportunities for prescriptions and expanding caregiver leave to better support the diverse needs of your family.

2025 Annual Enrollment Guide

For more information about all the changes, review the Annual Enrollment Guide.

View the Guide2025 Annual Costs

For more information on what you'll pay for health care benefits, review the annual paycheck costs.

View CostsChanges to Medical Plan Limits & Premiums

While our medical plan remains competitive with our peers, inflation continues to have an impact on the cost of health care. For this reason, annual deductibles, out-of-pocket maximums, and paycheck premiums will modestly increase for 2025.

Access the 2025 Medical Plan Comparison Chart to review the new premiums and plan limits.

Target Date Fund Updates

Effective October 4, 2024, the following changes were made in the fund line-up for the 401(k) & Profit Sharing Plan (401(k) & PSP) and other applicable plans:

- Target Date Fund 2025 was closed, and any participant balances was automatically moved to the Target Date Conservative Fund if you didn’t take action.

- Target Date Fund 2070 was added.

Expanded Coverage for Your Health and Wellbeing

In 2025, K-C will offer enhanced coverage for voluntary benefits through Voya—these benefits provide additional income protection in the event you have an eligible accident, a critical illness, or a hospitalization. Learn more about some of the 2025 enhancements for each benefit below.

- Accident Insurance: Increased coverage amount for sports accident benefits, common injuries, fractures, and more. Coverage has been added for mental health therapy, home health, critical care admission, etc.

- Critical Illness: Increased coverage amount for sudden cardiac arrest, coronary artery bypass, and more. Additionally, there will be a new wellness benefit added to coverage that will pay you and any covered dependent a $50 per person per year maximum benefit for health screenings and preventive care (e.g., physical, mammogram, colonoscopy).

- Hospital Indemnity: Increased coverage amount for admission, daily and ICU confinements, and rehabilitation benefits.

For more information on the income protection benefits available with Voya and how they work, attend the live webinar on October 17 from 2 to 3 p.m. ET. Register here.

Enhanced Prescription Benefits

Two Prescription Drug coverage features will provide additional savings and flexibility for you.

- PrudentRx: In 2025, CVS/caremark will team up with PrudentRx to help you save money if you or a covered dependent are taking certain specialty medications. If applicable, you or a covered dependent will receive a letter from PrudentRx with enrollment instructions later this year.

- More Ways to Fill 90-Day Prescriptions: Earlier this year, pharmacies were added to provide you with additional in-network options to fill 90-day prescriptions. In addition to CVS Pharmacy and CVS mail order, you can now fill your 90-day prescriptions at: Costco (including Costco’s Mail Order Pharmacy), Kroger-affiliated pharmacies, and more.

How to Enroll

Complete your 2025 Annual Enrollment between October 21 and November 1.

As you enroll, keep in mind:

- Adding a dependent to the My Dependents page doesn’t automatically enroll them in coverage. You must add them to each eligible benefit.

- You may see a “recalculating” message on your screen. This means the system is calculating your paycheck costs as you move through each benefit.

- For benefits that use your base pay to determine your coverage amount (e.g., life insurance), the system uses your pay as of July 1 (or your hire date if later) to calculate your coverage for the following year.

If You Don’t Take Action

If you don’t enroll by November 1, here’s what to expect:

- Medical Plan: If you do not enroll by November 1, your medical plan option will default to the plan you’re currently enrolled in. If you declined coverage in 2024, you’ll continue with no coverage in 2025.

- Medical Surcharge for Working Spouse/Partner: You’ll be charged the $100 monthly spouse/partner surcharge if your spouse/partner is currently enrolled in K-C medical coverage. Click here to learn more.

- Savings & Spending Account(s): You’ll have no employee savings or spending account contributions, meaning you’ll miss out on an opportunity to lower your taxable income.

- Tobacco-User Status: You’ll default to a tobacco/nicotine user, meaning you may miss out on the $240 tobacco-free discount on your annual medical paycheck costs.

After You Enroll

Once you’ve completed your enrollment, here’s what to expect:

- Confirmation Email: Within 24 hours of completing your enrollment, you’ll receive a confirmation email from Empyrean at your K-C email address.

- Changing Elections: If you need to make changes to your elections before enrollment ends, log in to kcbenefitcompass.com before 11:59 p.m. ET on November 1 and click Annual Enrollment Event – Confirmed.

- ID Cards: If you enrolled yourself or any covered dependents in medical coverage who aren’t covered in 2024, you’ll be mailed ID cards at the beginning of the year. You’ll also be able to access your digital ID cards for medical, dental, and vision through the My K-C Benefits app at the beginning of the year.

- Personalized App Experience: The My K-C Benefits mobile app will update with your 2025 elections at the beginning of the year.